What is a "Risks"? The Most Authoritative Explanation.

What are the different types of risks?

Broadly speaking, there are two main categories of risk: systematic and unsystematic. Systematic risk is the market uncertainty of an investment, meaning that it represents external factors that impact all (or many) companies in an industry or group.How do you manage risk?

Risk management can range from investing in low-risk securities to portfolio diversification to credit score approval for loans and much more. For investors, risk management can be comprised of balancing or diversifying portfolios with a range of high- and low-risk investments, including equities and bonds.How do you measure risk?

Quantifiably, risk is usually assessed by considering historical behaviors and outcomes. In finance, standard deviation is a common metric associated with risk. Standard deviation provides a measure of the volatility of asset prices in comparison to their historical averages in a given time frame.What is the definition of risk?

A risk is measured by the probability of a threat, the vulnerability of the asset to that threat, and the impact it would have if it occurred. Risk can also be defined as uncertainty of outcome, and can be used in the context of measuring the probability of positive outcomes as well as negative outcomes.Related Articles

What is a signal jammer?The five best ways to stop drones.

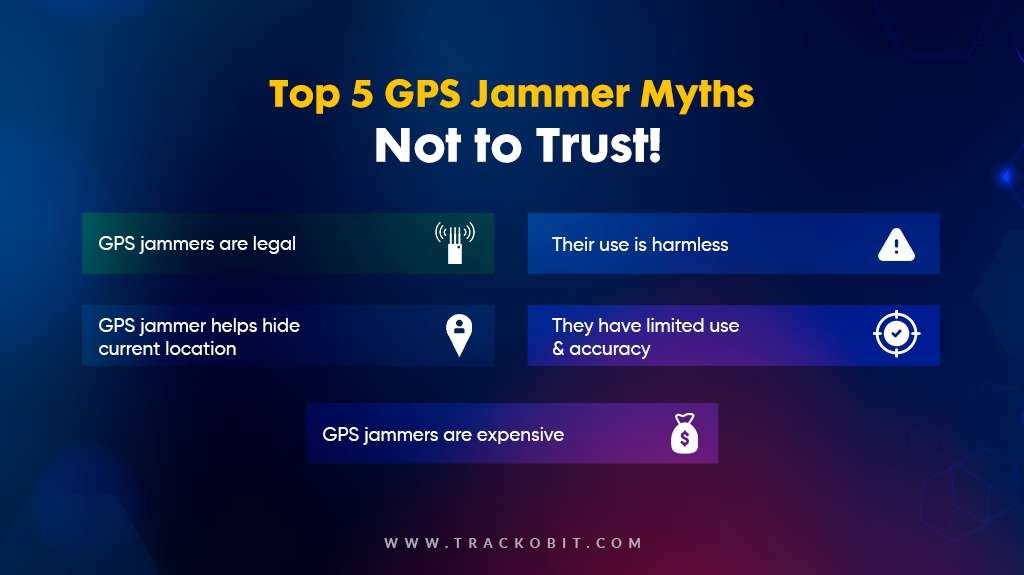

How to make a GPS Jammer? DIY your GPS jammer.

How to avoid interference from cell phone jammers?

How illegal drone are sold to USA?

GPS Jammer – Blocks private detective tracking.